View a screenreader-friendly version of this page.

State of the Marketplace is a quarterly report, offering a comprehensive analysis of the dynamic landscape within the beverage industry. Want to learn more? Check out our State of the Marketplace article that walks through the benefits and impact.

the big picture of the market

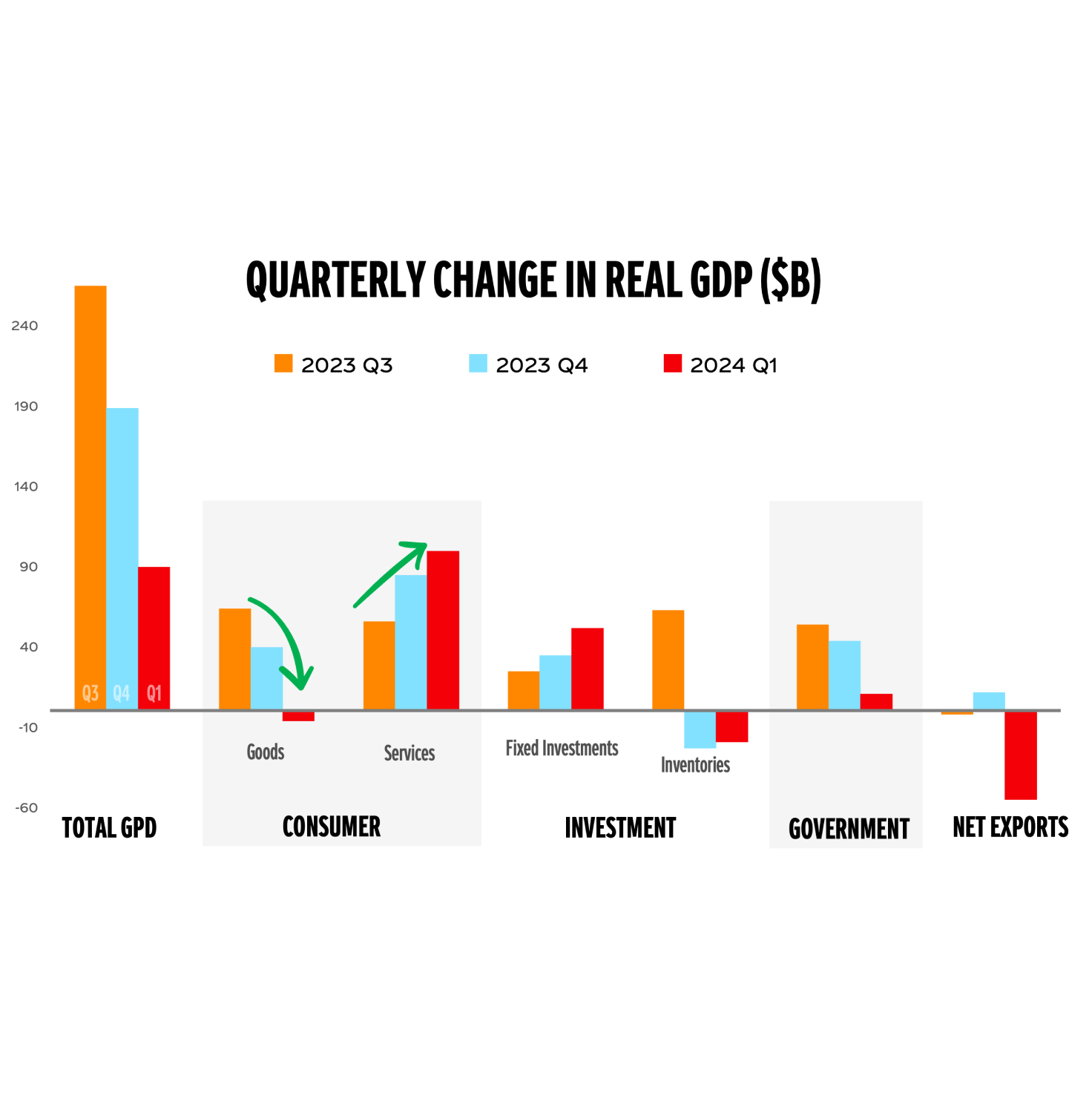

In 2024, Q1 showed a decline that reflected the decrease in consumer and government spending. However, increases in consumer spending on services was offset by a decline in goods spending.

Consumer spending on services was led by:

- healthcare

- financial services

- insurance

Goods spending may have be been lower, but was led by:

- gasoline

- other energy goods

It is important to note that increased government spending reflected increases in compensation for state and local government employees, primarily.

Source: U.S. Bureau of Economic Analysis

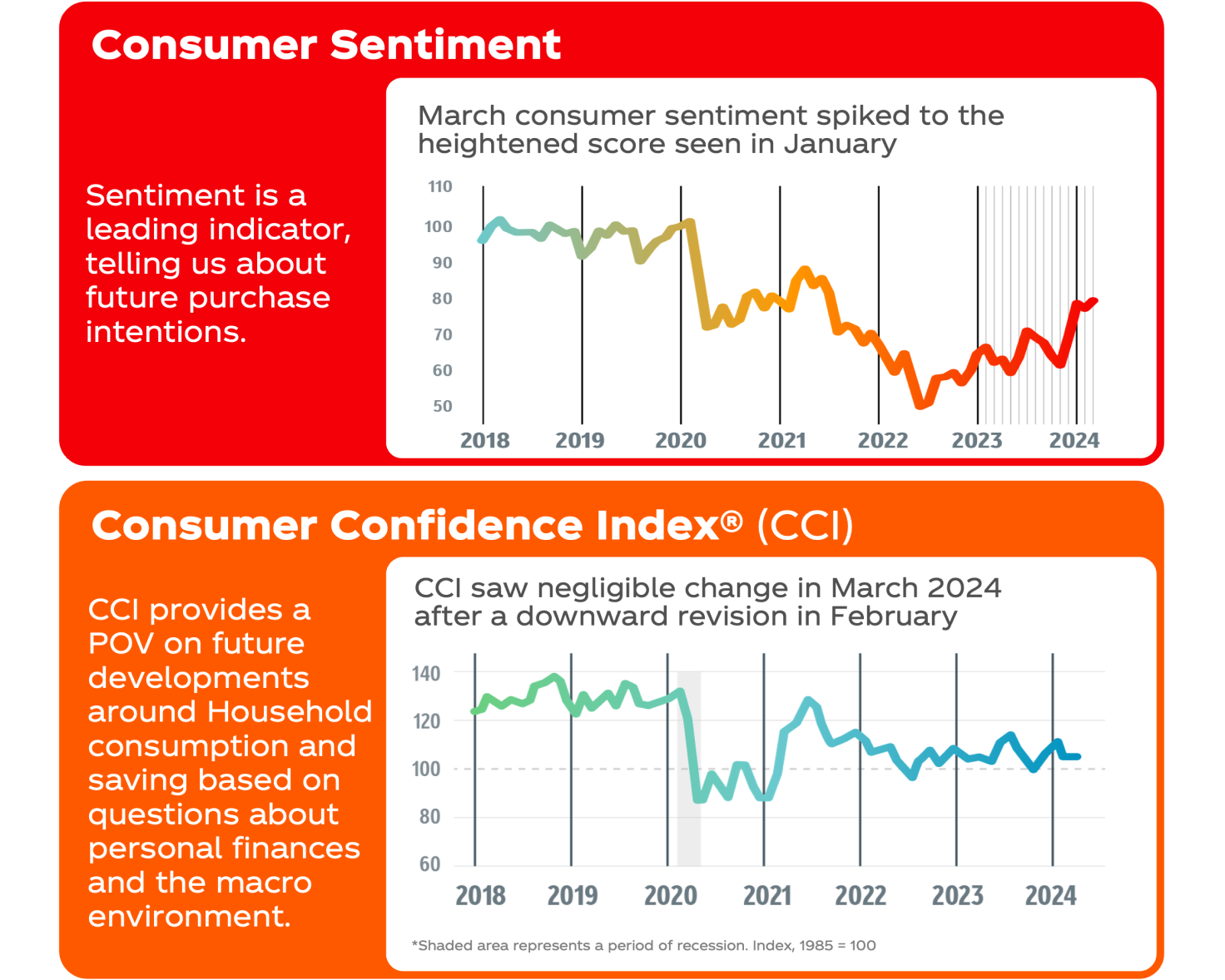

the ups and downs of consumer ratings

As consumer sentiment spiked again in Q1, consumer confidence saw a downward turn; consumer sentiment has been improving, but Consumer Confidence Index (CCI) reveals consumers may be less optimistic about the future.

Source: FRED – Bureau of Labor Statistics, Bureau of Economic Analysis The Conference Board; NBER

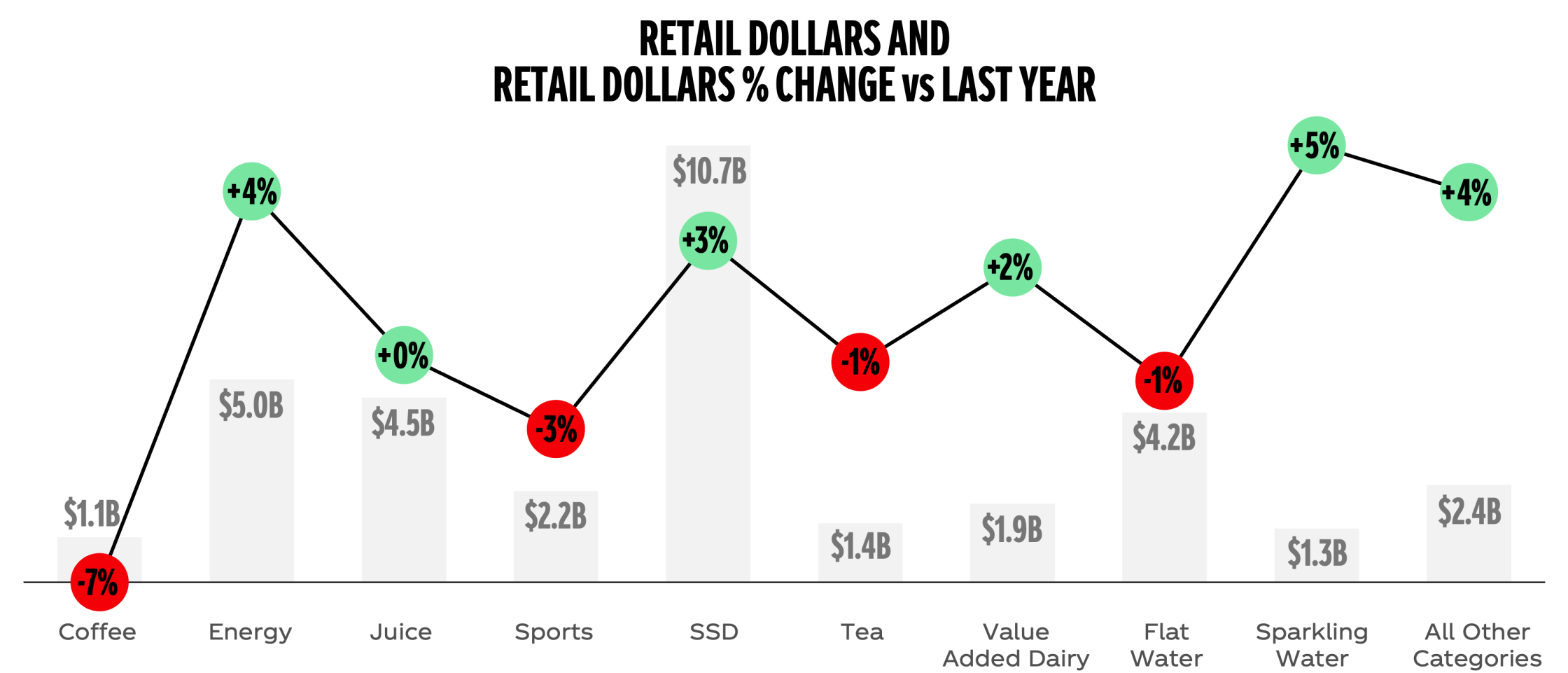

NARTD in retail

Total NARTD (non-alcoholic ready-to-drink) is up 1.6% in Retail Dollars in Q1, driven by strong growth in Energy, Sparkling Soft Drinks (SSD), and Value Added Dairy (VAD).

Source: NielsenIQ Total US AMC YTD as of W/E 4/6/24. Share shown for manufacturers (does not include System Brands)

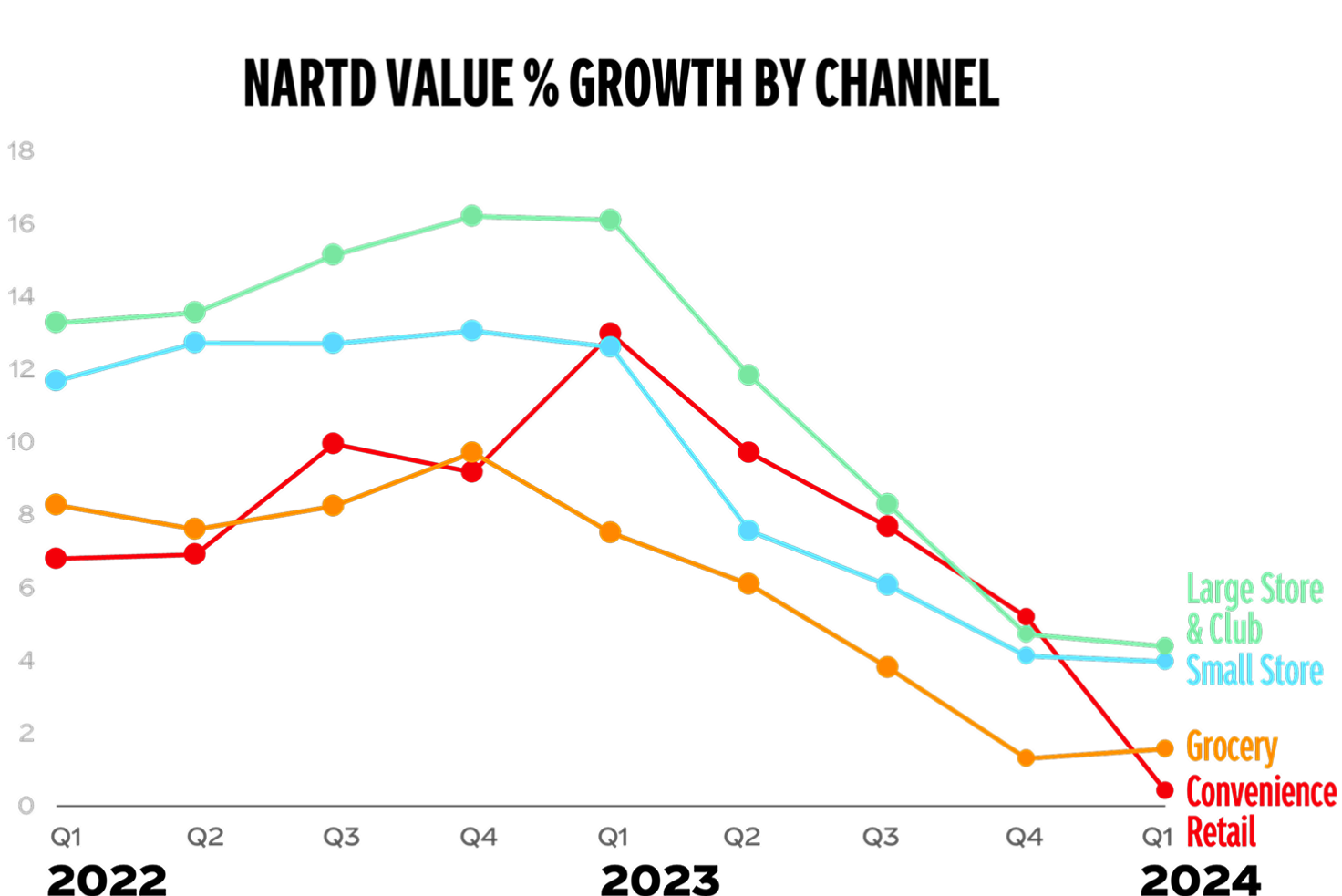

Channel develop-ments

Large Store & Club and Small Store channels continue to contribute an outsized share of growth. Convenience Retail (CR) had the slowest growth of 0.4%

Source: NielsenIQ Total US AMC; NARTD Comp Set (Excludes Conventional Dairy and Bulk Water) W/E 3/30/24

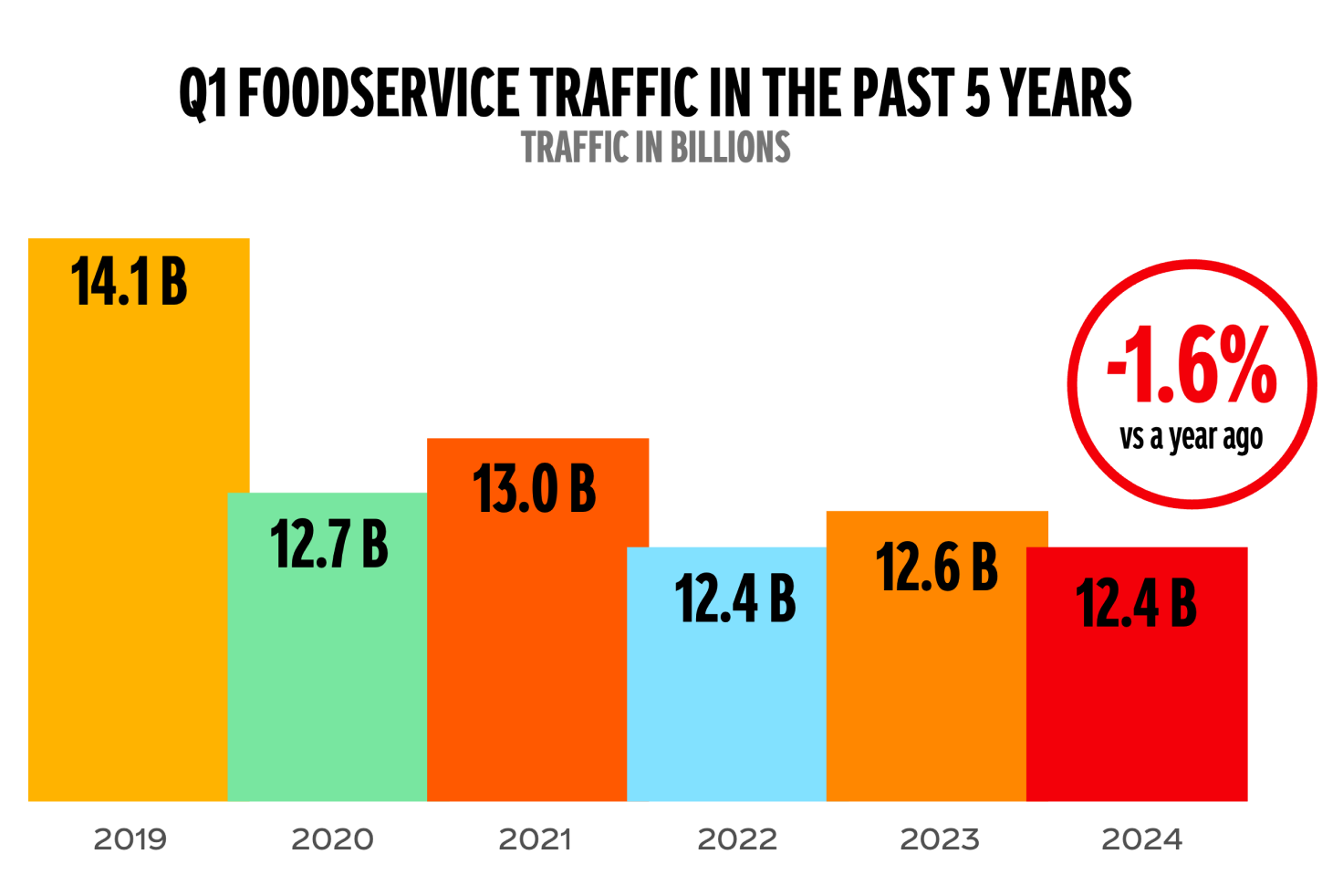

Foodservice declines

Meanwhile, Foodservice traffic in Q1 was down nearly 2% vs a year ago, driven by traffic decline at major chains.

Source: NPD CREST for Commercial Restaurants Only (Excludes Retail Foodservice, Excludes Starbucks); Beverages excludes alcohol, tap water, hot tea, hot chocolate, smoothies, and shakes/malts/floats

By evaluating the trends of yesterday, we

can see how they will impact today.

WANT TO SEE MORE?

Discover more through the lens in the articles below.