View a screenreader-friendly version of this page.

State of the Marketplace is a quarterly report, offering a comprehensive analysis of the dynamic landscape within the beverage industry. Want to learn more? Check out our State of the Marketplace article that walks through the benefits and impact.

MACROECONOMIC VIEW

The Big Picture of the Market

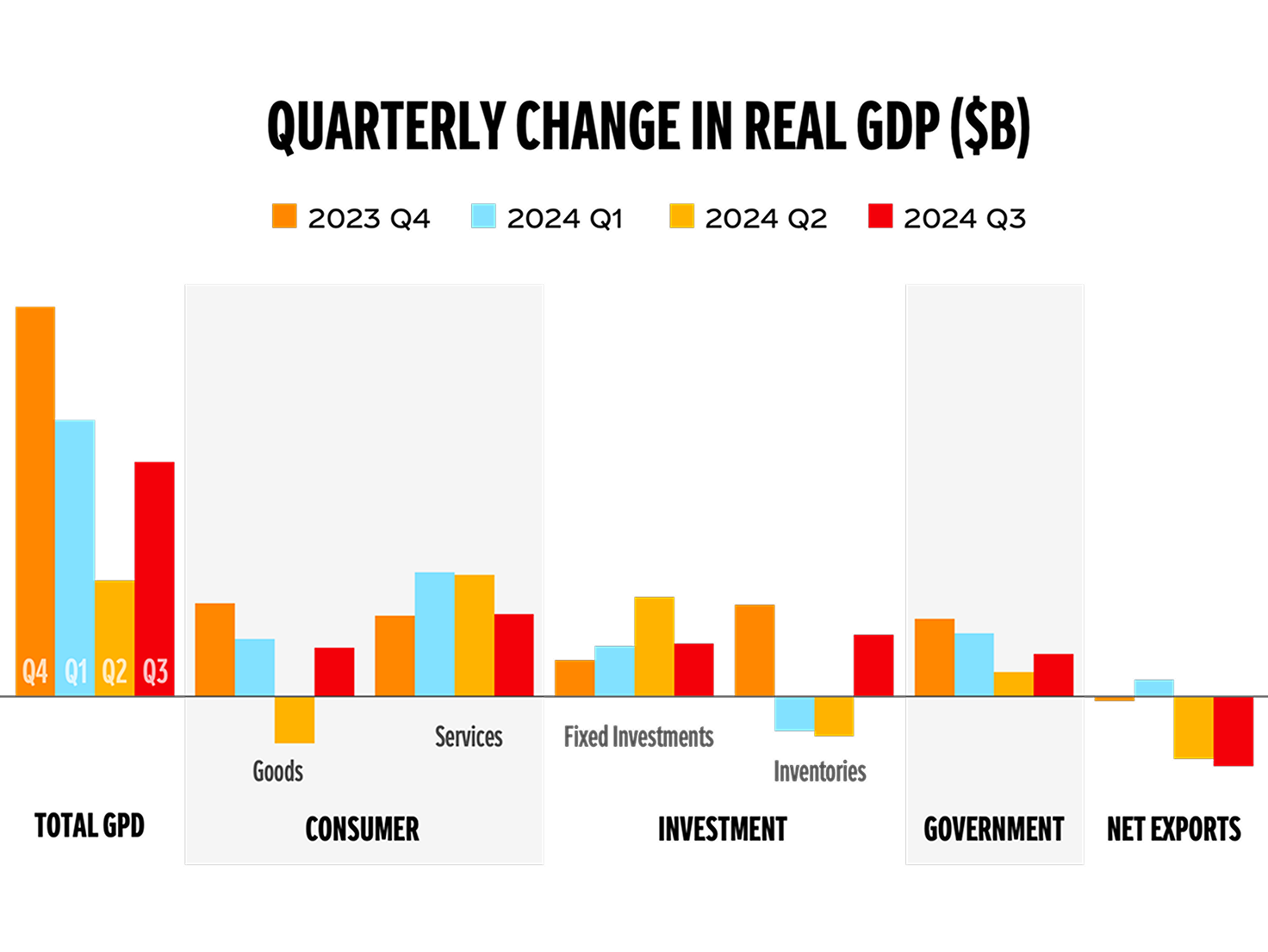

Q3 saw strong real GDP growth (+2.8%) with support from consumer and government spending. The quarter saw a smaller gap between real and nominal growth as headline inflation nears the Fed’s target.

Consumers continued to spend across a range of goods and services categories. Surges in defense spending and pharmacy supported growth from services and government spending.

- Services spending was led by healthcare and shelter, with support from rental price increases.

- Goods spending was strong in durables and non-durables, with growth coming from furnishings, groceries and autos.

Source: U.S. Bureau of Economic Analysis, Bain Macro Strategy Analysis

MACROECONOMIC VIEW

The Ups and Downs of Consumer Ratings

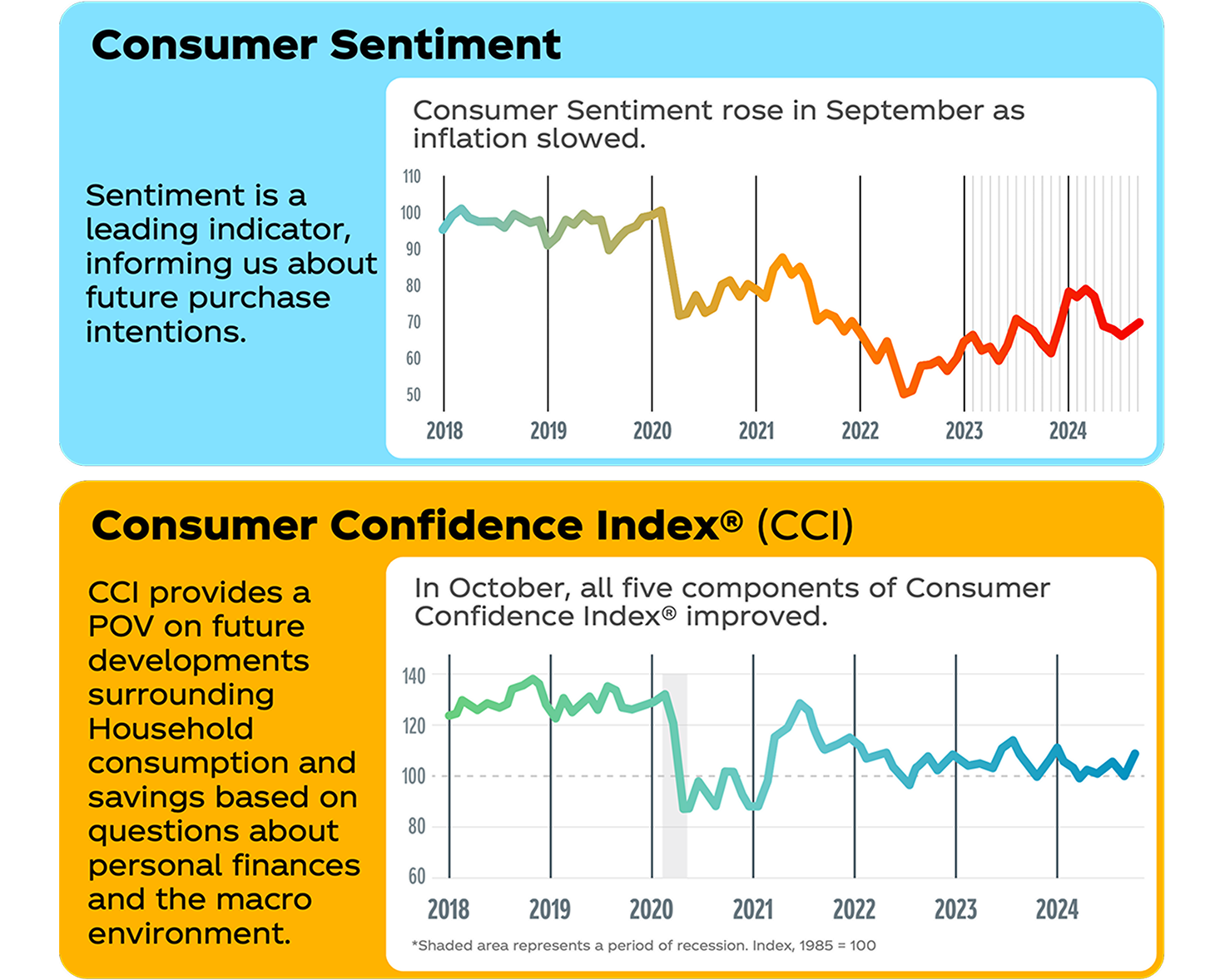

Consumer sentiment remained challenged, and consumer confidence ebbed and flowed in the narrow range it has sat in the last couple of years. However, sentiment ticked up the final month of the quarter while CCI posted a strong start to Q4. The CCI points to consumers who are younger and higher earners as being the most confident, while lower-income households report expectations of spending less on non-essential items in the next twelve months. Regardless, almost all household income groups saw higher confidence.

Source: FRED – Bureau of Labor Statistics, Bureau of Economic Analysis

NARTD RETAIL PERFORMANCE

NARTD in Retail

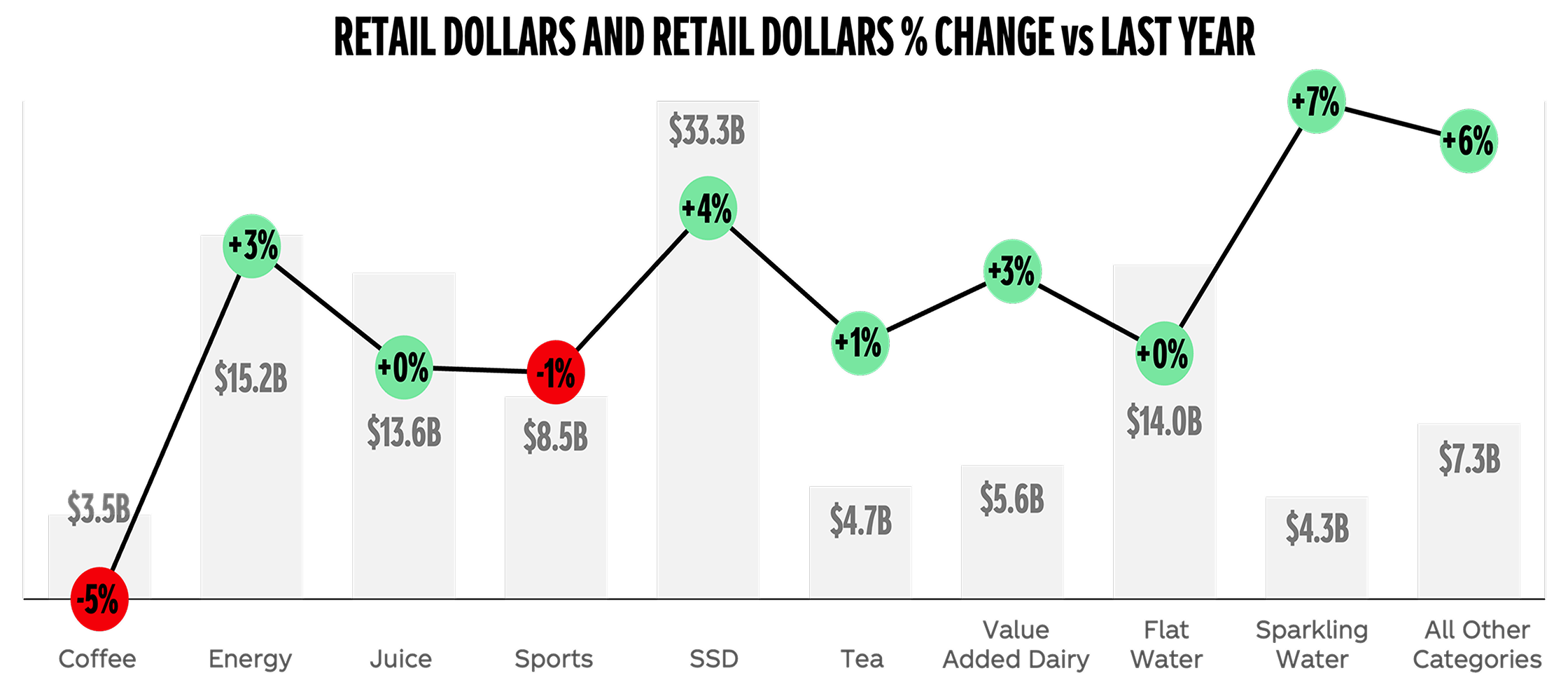

Total Non-Alcoholic Ready-to-Drink (NARTD) is up 2.4% in Retail Dollars YTD, driven by strong growth in Energy, Sparkling Soft Drinks (SSD), and Value-Added Dairy (VAD). NARTD growth was mainly driven by price/mix, with slightly negative volume for the quarter. SSD accounted for 57% of retail dollar growth YTD, while VAD had the highest growth rate of any category for the second quarter in a row (7%).

Source: Nielsen Total US AMC YTD as of W/E 10/12/24. Share shown for manufacturers (does not include System Brands)

RETAIL CHANNELS

Channel Developments

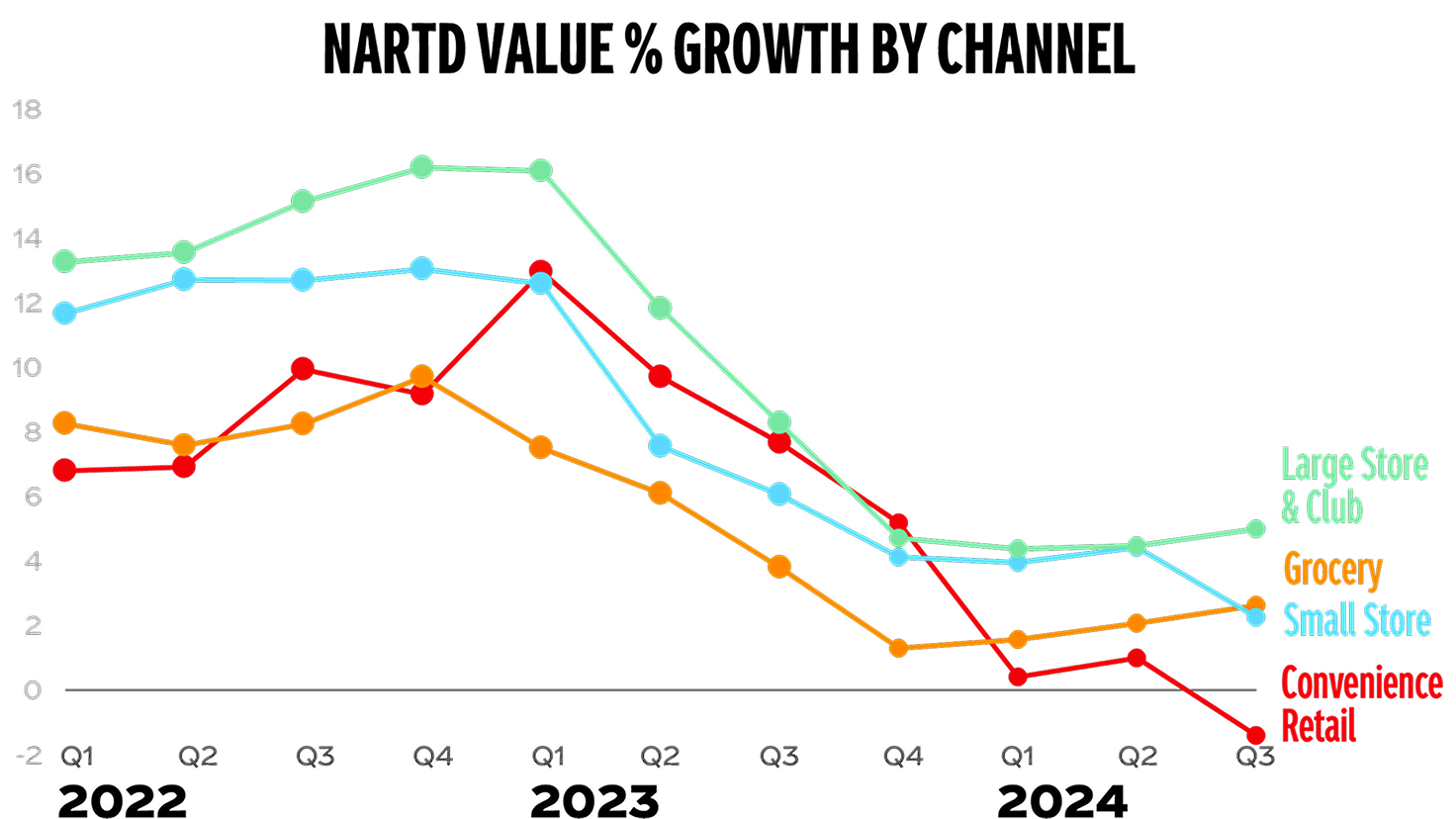

Large Store channels continued to experience the highest growth rates, with an increase of 5%.

In Q3, Coca‑Cola outperformed its primary competitors in the Food, Large Store + Club, and Convenience Retail (CR) channels.

Source: NA OU NielsenIQ Database; NARTD Comp Set (Excludes Conventional Dairy and Bulk Water) W/E 3/30/24

CATEGORY SPOTLIGHT

Clean Energy

What is the difference between Traditional and Clean Energy?

Clean Energy brands typically have higher caffeine content, lower sugar and added functionality compared to Traditional Energy.

Consumers’ continued preference for functionality and quality ingredients has fueled Clean Energy's growth and rapid evolution. Brands that provide healthier ingredients and increased functionality will lead the category forward.

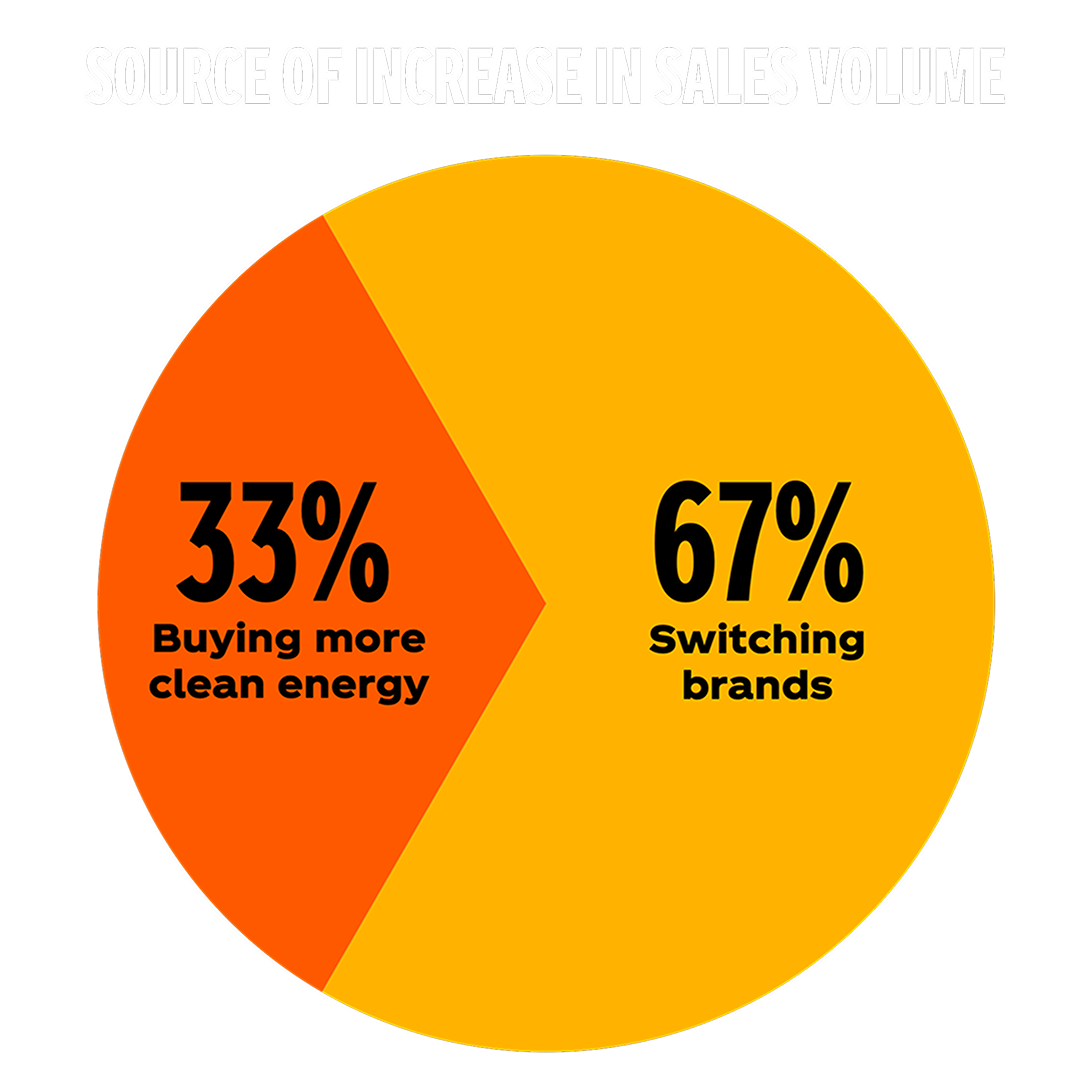

Clean Energy continues to grow and is a space of significant opportunity… growing at four times the rate of Traditional Energy!¹

Source: Numerator data from 09/12/23 – 09/08/24 ; cross purchase buyer overlap

FOODSERVICE TRENDS

Foodservice Changes

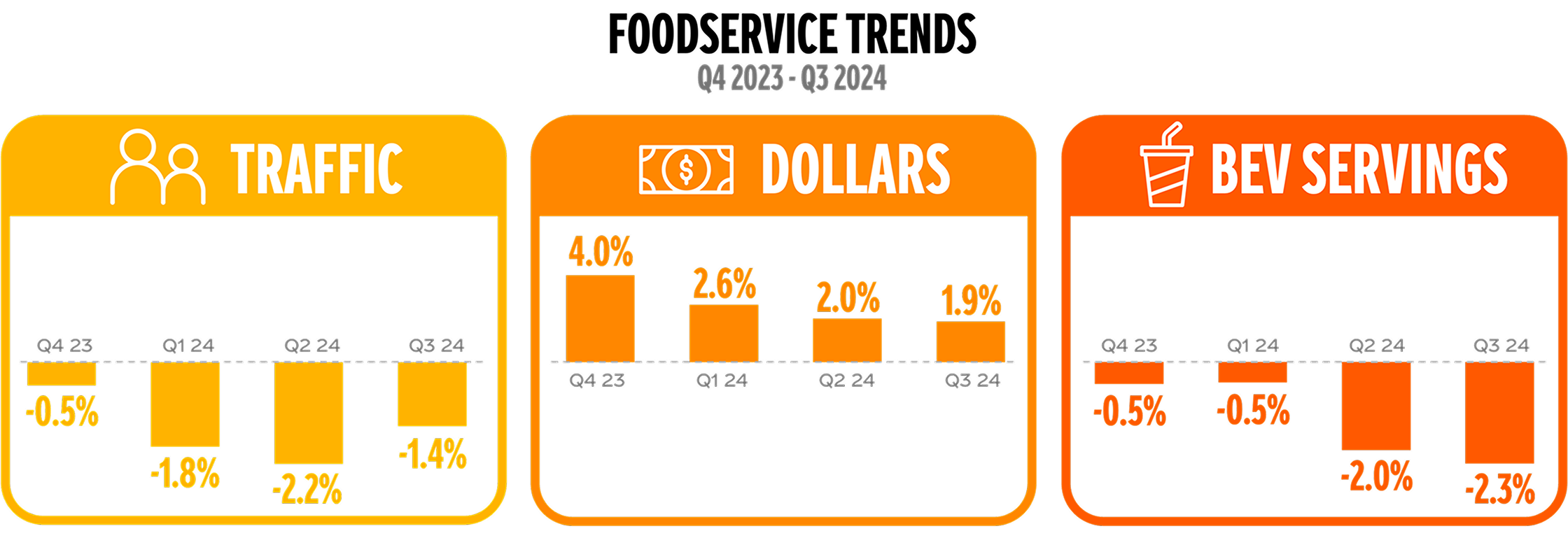

Foodservice faced a contraction, with customer traffic decreasing by 1.4% compared to last year and a decline in overall revenue growth. Beverage servings declined even more rapidly than customer traffic, resulting in reduced customer incidence. However, alcohol and other beverages performed better than soft drinks in the third quarter, indicating a potential opportunity for soft drink sales in a challenging market. Affordability was a significant concern, particularly for low-income consumers who risk being priced out of the market. In contrast, more affluent consumers were driving growth in the Fast Casual segment and sometimes opting for quick-service restaurants (QSR) instead. To attract more traffic, promotional deals, and digital integration have become crucial strategies.

Source: NPD CREST for Commercial Restaurants Only (Excludes Retail Foodservice, Excludes Starbucks); Beverages excludes alcohol, tap water, hot tea, hot chocolate, smoothies, and shakes/malts/floats

SHOPPER GUEST INSIGHTS

How People Plan to Shop

Most channels saw a decline in households purchasing beverages in Q3, though those that did, shopped more frequently in Food, Value, Club, and Online.²

High-income households are increasing at a faster rate of 14% compared to Coca‑Cola's NARTD growth of 11%, which resulted in a decline in penetration within this income group. Low-income and middle-income households also experienced a decline.³

Grocery prices are still a major concern for struggling shoppers, who plan to switch to more affordable brands and buy fewer items per trip.

Curious how it compares?

Compare this State of the Marketplace to last quarter’s!

By evaluating the trends of yesterday, we can see how they will impact today.

Source: 1) Nielsen Total US AMC YTD 2024 as of 9/10/24. 2) Numerator insights – Q3 2024, NARTD Total Shopper Comp Set. 3) Income % YTD Thru September, Monthly data 8/1/23 – 7/31/24